CLIMATE FINANCE TO INCOME COUNTRY.

CLIMATE FINANCE TO LOW INCOME COUNTRIES

To help to solve the global climate problem and aid lower income countries in making the transition to a more sustainable and resilient future, climate finance to lower-income and least developed countries is crucial. Even though they have contributed the least to global greenhouse gas emissions, low-income countries and least developed countries are frequently the most vulnerable to the effects of climate change.

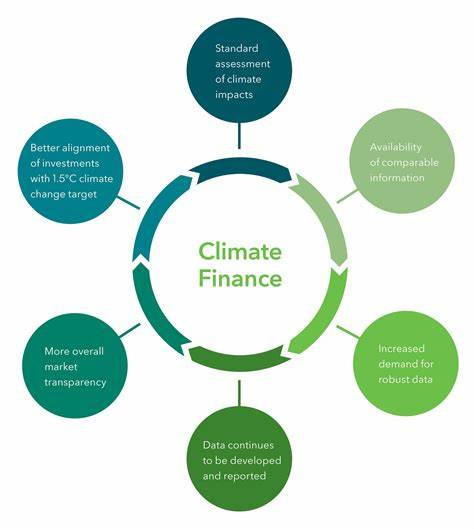

Climate finance therefore refers to the financial resources that are provided to support projects, initiatives, and policies aimed at mitigating and adapting to climate change. The main objective of climate finance is to address the challenges posed by climate change, reduce greenhouse gas emissions, strengthen resilience to the impacts of climate change, and promote sustainable development.

The United Nations presently designates 46 economies as least developed countries (LDCs), entitling them to preferential market access, funding, specific technical support, and capacity-building in technology, among other benefits. (Africa 33, Asia 9, Caribbean 1, Pacific 3)

The Committee for Development Policy (CDP), a group of independent specialists who report to the United Nations Economic and Social Council (ECOSOC), reviews the list of LDCs every three years. Following a triennial review of the list, the CDP may suggest countries for accession to the list or graduation from LDC status in its report to ECOSOC.

Climate finance can come from various sources including public funds, private investments, international climate funds and contributions from developed countries as part of their climate commitment.

various sources of climate finance

There are various sources of climate finance, which can be categorized into three main types which are, public, private and international sources.

Public sources include funds provided by national governments, international organizations, and multilateral development banks. Public sources consist of national budgets, climate funds such as the Green Climate Fund, and grants or concessional loans.

Also, private sources refer to investments made by individuals, businesses, and financial institutions in climate-related projects. Private sources may include commercial banks, private equity funds, venture capital, and philanthropic organizations.

International climate finance source refers to funds provided or committed by developed countries to support climate mitigation and adaptation efforts in developing countries. These funds are often part of cooperation agreements or commitments made under international frameworks such as the United Nations Framework Convention on Climate Change and the Paris Agreement.

Therefore, climate change mitigation and adaptation programs and efforts can be funded through procedures that have been put in place to raise and distribute money. With the support of these mechanisms, nations and communities can lessen their greenhouse gas emissions and make the transition to greener, more sustainable economies. Some of the primary methods for financing climate change include,

Green Climate Fund (GCF) is a global fund that aims to support developing countries in their efforts to reduce greenhouse gas emissions and adapt to the impacts of climate change. It provides financial resources for projects and programs in areas such as renewable energy, energy efficiency, and climate resilient infrastructure.

Also, adaptation Fund is a method of financing climate change. It was established under the United Nations Framework Convention on Climate Change (UNFCCC) to provide funding for adaptation projects and programs in developing countries. It primarily focuses on the most vulnerable countries and communities that are most affected by climate change.

.

In addition

In addition, global Environment Facility (GEF) which is an international financial institution provides funding for projects and programs that address global or environmental issues, including climate change. It supports initiatives in areas such as biodiversity conservation, sustainable land management, and technology transfer for climate mitigation and adaptation.

Again, there are carbon markets that are involve the trading of emissions allowances or credits, with the aim of reducing greenhouse gas emissions. This mechanism creates financial incentives for businesses and governments to reduce their emissions and invest in clean technologies.

There are climate investment funds too. These funds such as the Clean Technology Fund and the Scaling-up Renewable Energy Program, provide financial support for climate-friendly projects in developing countries. These funds aim to leverage private sector investments and promote the adoption of low-carbon technologies.

Bilateral and multilateral climate finance initiatives also help in financing any countries and international organizations to established their own climate finance initiatives to support climate action in developing countries. Examples include the Climate Investment Platform, the Partnership for Market Readiness, and the European Union’s Climate Finance Instrument. These climate finance mechanisms play a crucial role in mobilizing resources and facilitating the implementation of climate change mitigation and adaptation measures. By providing financial support, they help countries and communities transition to low-carbon, climate-resilient economies and build resilience to climate impacts.

Climate finance is of utmost importance to lower-income countries for several reasons as it plays a pivotal role in addressing the unique challenges and vulnerabilities these nations face in the context of climate change

Adaptation to climate change again, helps low-income countries because, often times these countries do not have the means and infrastructure required to adapt to the negative consequences of climate change. Climate finance enables them to develop resilient infrastructure, early warning systems and measures to safeguard vulnerable communities from climate related disasters such as floods, droughts and extreme weather events.

In Poverty Reduction, climate funding can be directed toward projects that create economic possibilities, improve livelihoods, and help people escape poverty. Investments in sustainable agriculture, renewable energy, and clean water supply, for example, can benefit local communities’ economic well-being.

Conversion of energy here means that energy is often dependent on fossil fuels in low-income countries. Climate finance can help speed up the transition to cleaner, more sustainable energy sources, lowering greenhouse gas emissions and air pollution while enhancing energy access and security.

Building a capacity also helps because there is a frequent involvement in climate finance which involves, frequent involvement in support for capacity building and technical assistance, assisting low-income nations in developing skills and knowledge required to plan, implement and manage climate initiatives efficiently. This in turn gives local institutions and government more influence.

While climate finance can help low-income nations handle climate change and its associated concerns, there are a number of drawbacks or potential issues to consider.

First and foremost, reliance on external funding is a drawback because low-income countries may grow dependent on climate money from outside sources. This reliance may limit their ability to develop long term sustainable climate mitigation and adaptation.

Also, Funding on a conditional basis is a disadvantage to lower income countries. Climate funding frequently includes conditions and criteria that countries must achieve in order to receive funds. These conditions may not necessarily correspond to a country’s specific requirements and satisfying them may redirect resources away from other vital development goals.

Corruption Risk is another negative factor in climate finance. Due to the high sums of money involved in climate funding, potential for corruption and mismanagement exist. Lower-income countries with poorer governance frameworks may be especially prone to such dangers.

Another disadvantage is Concerns about debt. Sometimes climate money is supplied in the form of loans, which can increase a country’s debt burden. High debt levels can limit a country’s budgetary flexibility and cause financial instability.

Some ways to curb the above disadvantages of climate finance are as follows;

Transparency: to minimize corruption and promote accountability, climate financing should be allocated and used in a transparent manner.

Secondly, lower-income countries must be allowed to take ownership of their climate programs and policies while respecting their sovereignty and aligning with their development objectives

Also, mitigation and Adaptation may help because, climate finance should strike a balance between mitigation and adaptation initiatives, recognizing that low-income nations are frequently more vulnerable to climate consequences.

In conclusion, climate finance to low-income nations is critical to solving the global issues posed by climate change. It provides an opportunity to assist these countries in both mitigating and adapting to the effects of climate change. However, the success and fairness of climate funding are dependent on rigorous planning, accountability, and consideration of each recipient country’s individual requirements and conditions. While climate finance has benefits such as funding for green initiatives and technology transfer, it also has drawbacks such as dependency, conditional funding, and possible dangers.

Successful climate finance should serve as a stimulus for low-income countries’ sustainable, egalitarian, and resilient development, contributing to the global effort to tackle climate change while also addressing local development needs and goals.